“What you save up in your KiwiSaver account will have a massive impact on your quality of life in retirement.”

When you retire, it could mean the difference between choosing where to travel next, and worrying about how to pay your bills. It’s easy enough not to realize how quickly the little amounts set aside now can grow into big dollars in the future.

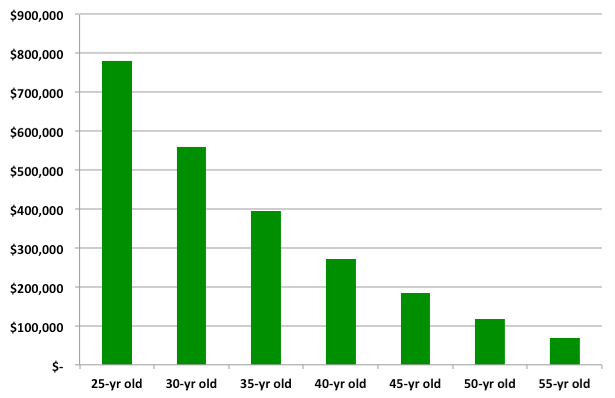

Let’s see how much you might save up by the time you retire.

Say, you are on a $60,000 annual salary and contributing the minimum 3% into your KiwiSaver account. On this basis you will be saving $1,800 in your KiwiSaver account each year. If you are paid your salary monthly, that’s like putting aside about $150 a month for your future.

Your employer also tops up your KiwiSaver account by 3%. Also, subject to certain conditions the Government provides a rebate (like a top up) into your KiwiSaver account.

The chart below gives you an indication of how many dollars you will have saved up in your KiwiSaver account when you retire. Take for example a 30-year old. You can see from the chart that they have over a cool half a million saved up when they retire – all that from putting aside just $150 each month!

Assumptions: Current KiwiSaver account balance of $10,000, salary of $60,000 with wage inflation of 2%, contribution rate of 3%, matched by the employer and a KiwiSaver fund earning an average return of 6% p.a

So what ARE you doing to grow your KiwiSaver account as fast as possible?

“A little bit of your attention NOW can make a massive difference to how much you enjoy your retirement”

Consider this – a 3% p.a. higher return each year from another fund, can double the amount you will have in retirement! It’s just math.

Using our earlier example of the 30-yr old. In a fund that earns 6% p.a. she will have about $560,000 saved up. In a fund that earns 9% p.a. that will rise to about $1.1 million dollars.

Did you know that there are about 243 KiwiSaver funds you can choose from? Returns from these funds have ranged between 3% p.a. to around 20% p.a. in the last 5 years!

There are a few simple things you can do NOW to build the future you wish to live, that we’ll cover off in our four part series on ‘how to rev up your KiwiSaver’.